Planned Giving – CRTs

Charitable Remainder Trusts

What Is A Charitable Remainder Trust (CRT)?

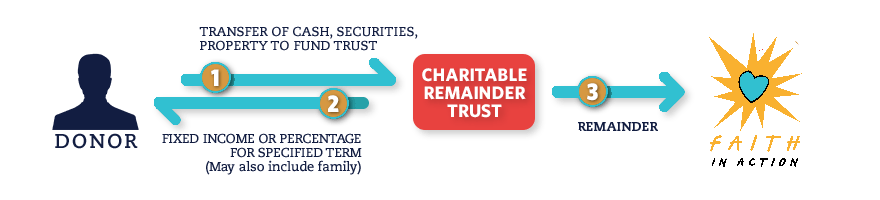

Charitable Remainder Trust distributes income to a donor or other beneficiaries for their lives, or in some cases, a specified term of years. Upon the termination of the trust, after the death of the final beneficiary or after the term of years, all assets in the trust will be distributed WFIA.

Charitable Remainder Trusts offer many opportunities to address specific goals and situations for donors. For example, CRTs are frequently used as a means of providing supplemental income during retirement, and can be especially attractive as a way to convert appreciated, low-yielding assets into a high-yielding diversified portfolio without incurring capital gains tax. Charitable Remainder Trusts can even hold more complex assets including real estate and stock of privately held corporations.

Charitable Remainder Trusts Have Two Basic Structures

Charitable Remainder Unitrusts (CRUTs): A standard CRUT distributes a fixed percentage of the value of the assets in the trust. The trust is valued once each year and the annual payment is split into four equal quarterly installments. A standard CRUT must distribute at least 5 percent of the value of the trust each year. The specific payout rate is stated in the trust document and will not fluctuate. Over time, the goal is to increase the value of the trust, and as a result, the payments from the trust. CRUTs with payout rates between 5 percent and 6 percent and invested for total return tend to experience increases in beneficiary payments that keep pace with inflation over the long-term.

Charitable Remainder Annuity Trusts (CRATs): A Charitable Remainder Annuity Trust (CRAT) pays income based on a percentage of the initial value of the trust and the payout amount never changes. As a result, an annuity trust provides a fixed dollar amount of income each year regardless of any fluctuations in the value of the trust assets. Payments of the annual annuity are made each year regardless of the income earned by the trust, and they are backed by the total amount of the assets held by the trust.

Contact Us

If you have any questions about Charitable Gift Annuities, please Contact Us. Call 757-258-5890 or email bminett@wfia.org. We would be happy to assist you and answer your questions.